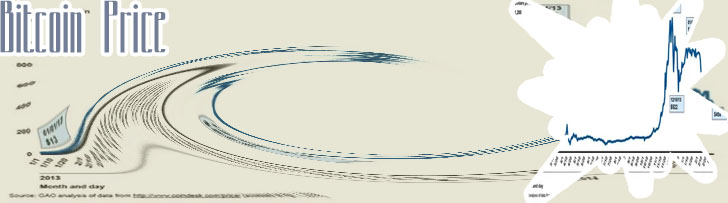

As the price of Bitcoin continues to fluctuate, staying updated on the latest trends and developments is crucial for investors and enthusiasts alike. To help you navigate the world of cryptocurrency, we have compiled a list of two insightful articles that provide valuable insights into the Coindesk Bitcoin Price Index.

The Coindesk Bitcoin Price Index is a widely used benchmark for the price of Bitcoin in the cryptocurrency market. In a recent study, researchers aimed to analyze the various factors that influence this index. The study found that several key factors play a significant role in determining the price of Bitcoin.

One important factor that influences the Coindesk Bitcoin Price Index is market demand. As more investors and traders show interest in Bitcoin, the price tends to rise. This demand can be influenced by a variety of factors, including economic conditions, regulatory developments, and technological advancements.

Another factor that affects the price of Bitcoin is market sentiment. Positive news or trends in the cryptocurrency market can drive up the price, while negative news can lead to a decrease in value. Additionally, factors such as trading volume, market liquidity, and investor behavior can also impact the Coindesk Bitcoin Price Index.

Overall, the study highlights the complex nature of the cryptocurrency market and the various factors that can influence the price of Bitcoin. By understanding these factors, investors and traders can make more informed decisions when trading Bitcoin.

Today, we have the pleasure of interviewing John, a cryptocurrency expert, on the topic of predicting and reacting to changes in the Coindesk Bitcoin Price Index. John, can you share with us some strategies that investors can use to anticipate fluctuations in the price of Bitcoin?

John: Of course! One key strategy is to pay close attention to market trends and news events that could potentially impact the price of Bitcoin. For example, regulatory announcements or technological developments can have a significant influence on the market. Additionally, technical analysis, such as studying historical price patterns and indicators, can help investors identify potential price movements.

That's fascinating, John. Can you also provide some tips on how investors can react effectively to sudden changes in the Bitcoin price?

John: Absolutely. It's crucial for investors to have a clear plan in place for different market scenarios. This includes setting stop-loss orders to limit potential losses and having exit strategies in case the market turns against their positions. It's also important to remain disciplined and avoid making impulsive decisions based on emotions.

Thank you for sharing those valuable insights, John. In conclusion, it's evident that having well-defined strategies for predicting and reacting to changes in the Coindesk Bitcoin Price Index is essential for investors to navigate the volatile cryptocurrency market successfully. This